Reserve Bank of Australia (RBA) governor Michele Bullock has explained why the central bank considers it vital to defeat inflation, even if it means keeping interest rates higher for longer.

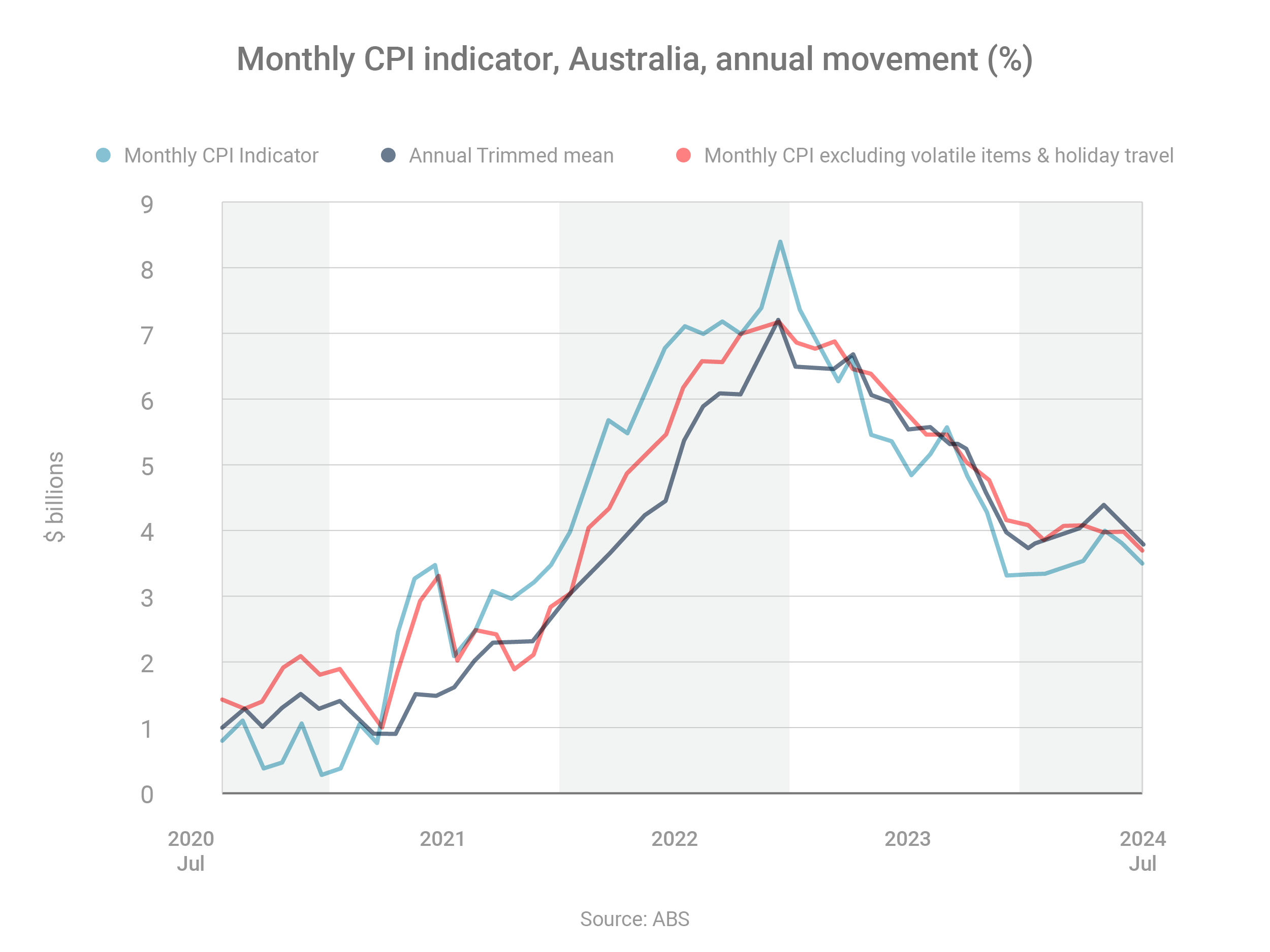

Inflation fell from 3.8% in June to 3.5% in July, according to the latest data from the Australian Bureau of Statistics, but remains above the RBA’s target range of 2-3%.

In a keynote address earlier this month, Governor Bullock said the RBA was aware that higher interest rates were causing hardship to some businesses and households. However, if high inflation became entrenched in the expectations of firms and households, even higher rates would be needed to solve the problem.

Governor Bullock also said elevated inflation made it harder to plan for the future.

“It can distort economic activity, affecting decisions about investment and employment and ultimately hurting productivity and household incomes. For example, it might be hard for a firm to lock in a supply contract if it doesn’t know what prices are going to be over the next year. In turn, this might make it harder to make expansion plans,” she said.

“High and variable inflation can also cause shifts in people’s wealth and spending power. Agreeing to a new contract, or making saving plans, is harder if you don’t know how expensive things will be in the future.”

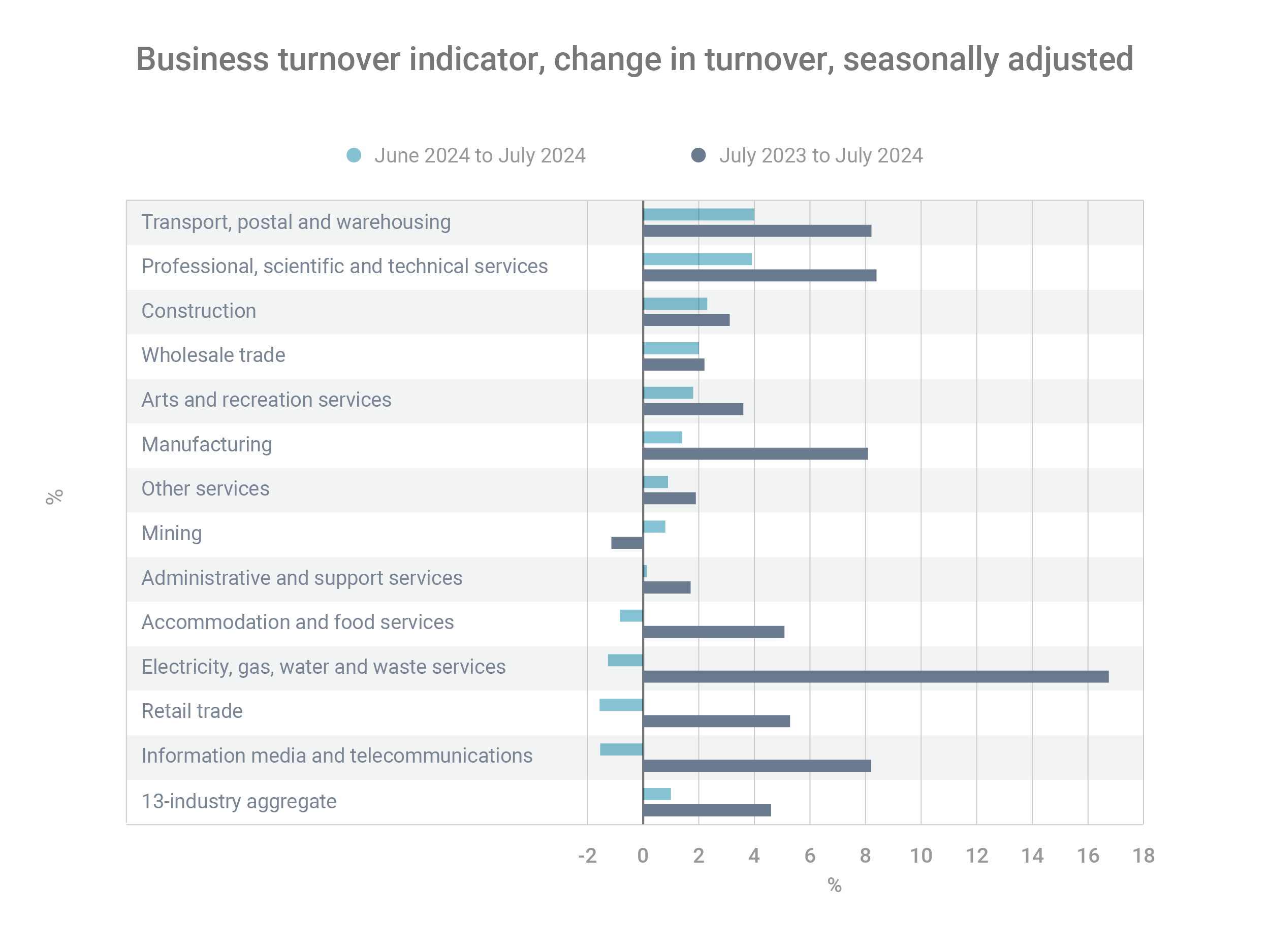

In encouraging news for businesses, turnover has increased for most industry groups.

Nine of the 13 industry divisions monitored by the Australian Bureau of Statistics recorded month-on-month increases in monthly turnover in July, while 12 recorded year-on-year increases.

Nevertheless, these remain challenging times for businesses – interest rates and inflation are uncomfortably high, while retail spending is declining in inflation-adjusted terms.

The Reserve Bank of Australia has forecast that the economy has bottomed out and will strengthen. GDP growth, which was just 1.0% through the year to June 2024, is expected to rise to 1.7% by December and 2.6% by June 2025.

Let’s hope things do, indeed, get better. In the meantime, if your business wants to improve its financial position, I might be able to help.

Potential solutions include refinancing to a lower-rate loan, extending your loan term (to reduce your monthly repayments) or securing a line of credit.

If certain tax laws have produced unexpected or unintended outcomes for your business, the Australian Taxation Office (ATO) commissioner may be willing to intervene.

The commissioner’s remedial power (CRP) may be used to change how a tax law operates so it works as intended.

“If you believe a tax law isn’t working as it’s supposed to, you can submit a request for us to investigate whether we can use the CRP to resolve your issue,” according to the ATO. To submit a request, you will need to:

-

Check if your request meets the limited eligibility requirements

-

Fill out an an online form and include details about how you believe the law can be changed

“We find that most requests submitted to us are unsuitable because the proposed law changes are at odds with what the law was originally intended to achieve,” the ATO said.

“Other reasons we find requests unsuitable include where the proposed change would have more than a negligible impact on the Commonwealth budget [and] only help one taxpayer (rather than everyone or a group of taxpayers).”

The ATO website has examples and case studies of when you can and can’t use CRP.

The Xero Small Business Index recorded a sharp rise in business performance in June, although this was likely due to seasonal factors associated with the end of the financial year.

The index – which is based on sales, jobs, wages and time to be paid – rose from 125 points in April to 139 points in May and, most recently, to 162 points in June. However, Xero said the big rise between May and June was “largely due to a big improvement in the payment time metric, something that is observed at the end of every financial year and gets unwound in subsequent months”.

As a result, Xero felt the April-May average of 132 points was “likely more indicative of the current state of small businesses in Australia”.

Between July 2023 and May 2024, the average time to be paid stayed within a narrow band between 22.2 and 22.8 days; it then plunged to 19.1 days in June, presumably because a significant number of debtors wanted to clear their bills before the end of the financial year.

Overall, the Xero data suggests the environment for small businesses is improving, but remains challenging.