Real Estate market records smashedWatch the video below or read the blog.

The Perth Boom: Unravelling the Remarkable Surge

Perth has emerged as a standout performer in Australia’s property market, showcasing remarkable growth that surpasses all other capital cities. With a substantial increase of 10.9% in property prices this year, Perth has outpaced its own historical average by more than fivefold. This upward trajectory reflects an extraordinary 3% price surge in this quarter alone. Notably, while house prices continue to perform well, unit prices took the lead this quarter, an occurrence not witnessed since 2021. Such a trend indicates the dynamic and diverse nature of the property market in Perth.

Factors Driving Perth’s Growth

A key driver behind Perth’s soaring property market is the remarkable imbalance between supply and demand. The Real Estate Institute of Western Australia reported a median time on the market of just eight days in the recent month, setting a new record. This rapid turnover of properties signifies an unprecedented demand that surpasses available housing stock, contributing to the sharp surge in property prices.

The recent focus on Perth’s property market is not only due to its outstanding growth but also because the city remains relatively affordable compared to major eastern cities. This affordability, coupled with the substantial growth and attractiveness to interstate migrants, positions Perth as an intriguing prospect for potential property investors or homebuyers who might face constraints in markets like Sydney or Melbourne.

Understanding Migration’s Impact on Property Prices

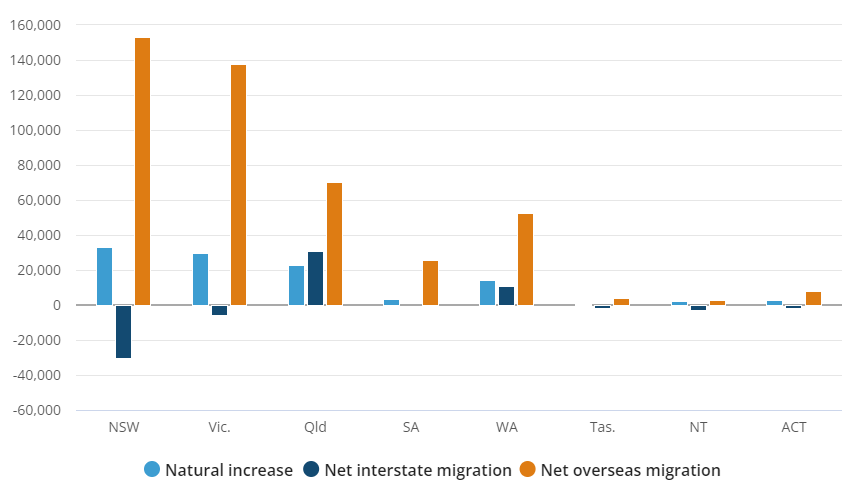

When considering the impact of migration on property prices, it’s essential to distinguish between international and interstate migration. While international migration does exert some pressure on property prices, it predominantly affects the rental market. Many new arrivals tend to rent initially and then, over time, transition to property ownership.

On the other hand, interstate migration plays a pivotal role in influencing property prices. Regions experiencing robust interstate migration, such as Western Australia and Queensland, witness a larger proportion of financially capable migrants who are more ready to buy. The Australian Bureau of Statistics (ABS) data highlights the substantial influx of migrants into WA and QLD, setting these states apart from others. This strong migration flow contributes significantly to the demand for housing, subsequently influencing property prices.

The record level of international migration, coupled with robust interstate migration, has notably contributed to a surge in rental prices. Regions like regional Western Australia and Perth have experienced substantial year-on-year increases in advertised rents. Despite this, when considering the relatively lower median house prices compared to the east coast, the potential and affordability of the Perth property market become increasingly appealing, especially for investors looking to diversify their portfolio or individuals seeking a viable investment opportunity.

Supply and Demand in the Property Market:

Shortage of Available Housing

Across various regions, a significant shortage of available housing is evident. The data from CoreLogic in August unveiled that dwelling approvals were 21% below the decade average. This glaring shortage stands as a bottleneck, hindering the market from meeting the increasing demands of potential homeowners and tenants. The ambitious government target of constructing 1.2 million new homes, while commendable, remains unattainable, leading to a glaring gap in housing availability. This inability to bridge the demand-supply gap is particularly exacerbated in high-demand regions, further driving property prices upward.

Implications of Insufficient Supply

The repercussions of inadequate supply ripple through various facets of the property market. The scarcity of available housing not only intensifies the competitive nature of real estate transactions but also propels soaring property prices, creating hurdles for first-time buyers and investors seeking entry into the market. As demand outstrips supply, there’s a resultant strain on the rental market, elevating rents due to limited available properties.

Factors Contributing to the Supply Shortage

The supply shortage isn’t solely attributed to the failure to meet construction targets. Several factors compound this situation. The complexities within the construction sector, including rising costs and limited profit margins, have deterred developers from executing new projects. The ABS data points towards certain major home builders facing insolvency, highlighting the challenges faced by construction companies in managing escalating costs and adhering to fixed-price contracts in the face of inflation.

The remarkable escalation in construction costs, albeit showing signs of stabilisation, remains a significant deterrent to prospective developers. The unrelenting rise in construction expenses, while seemingly steadying, has created substantial hesitancy among investors and developers, impacting their willingness to embark on new building projects. Consequently, this hampers efforts to address the supply shortage, perpetuating the existing scarcity of available properties.

Navigating the Current Landscape

For property owners, the shortage signals a positive outlook, as the limited availability of housing contributes to potential rental growth, ultimately benefiting landlords. However, for prospective buyers, especially those on the sidelines contemplating market entry, exploring properties in less competitive or more affordable suburbs becomes a viable strategy. Seeking guidance from professionals like buyer’s agents and mortgage brokers can provide insights into augmenting borrowing capacities and identifying alternative entry points into the property market.