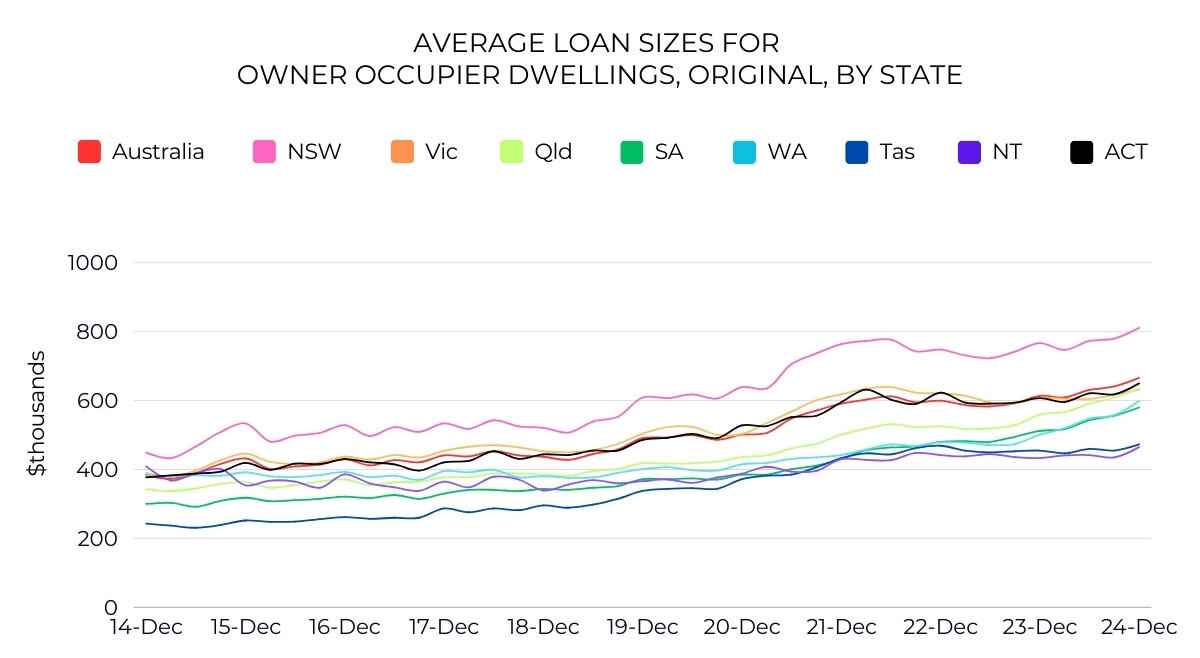

Owner-occupiers are stepping up in the property market as investors are stepping down, according to new data from the Australian Bureau of Statistics, while average loan sizes now range from $465,000 in the Northern Territory to $811,000 in New South Wales.

During the final three months of the year, loan commitments fell 4.5% quarter-on-quarter for investors while rising 2.2% for owner-occupiers, reflecting a changing dynamic in the market.

Meanwhile, the average mortgage across Australia reached a record $666,000 at the end of 2024, an increase of 8.5% on the year before.

Given those large loan sizes, accumulating a deposit can be hard. So here are five things you can do to either save your deposit faster or reduce the size of the deposit required:

The federal government has announced plans to ban foreign investors from buying established homes and to crack down on illegal land banking, in an effort to cool demand and increase supply.

Foreign investors need to apply for approval before purchasing residential real estate in Australia. Under the current rules, they’re generally restricted to buying new properties although they are allowed to buy established properties under certain circumstances. Under the new rules, they will be banned from buying established properties between 1 April 2025 and 31 March 2027; a review will then be conducted to decide whether to continue the ban.

The government will also take action against foreign investors who buy vacant land, sit on it and then sell it for a profit, rather than following the regulations that require them to put the land to productive use within reasonable timeframes. To enforce the policy, the government will provide funding to the Australian Taxation Office to do more auditing and compliance work with foreign investors.

“This is all about easing pressure on our housing market at the same time as we build more homes,” Housing Minister Clare O’Neil said.

“These initiatives are a small but important part of our already big and broad housing agenda which is focused on boosting supply and helping more people into homes.”

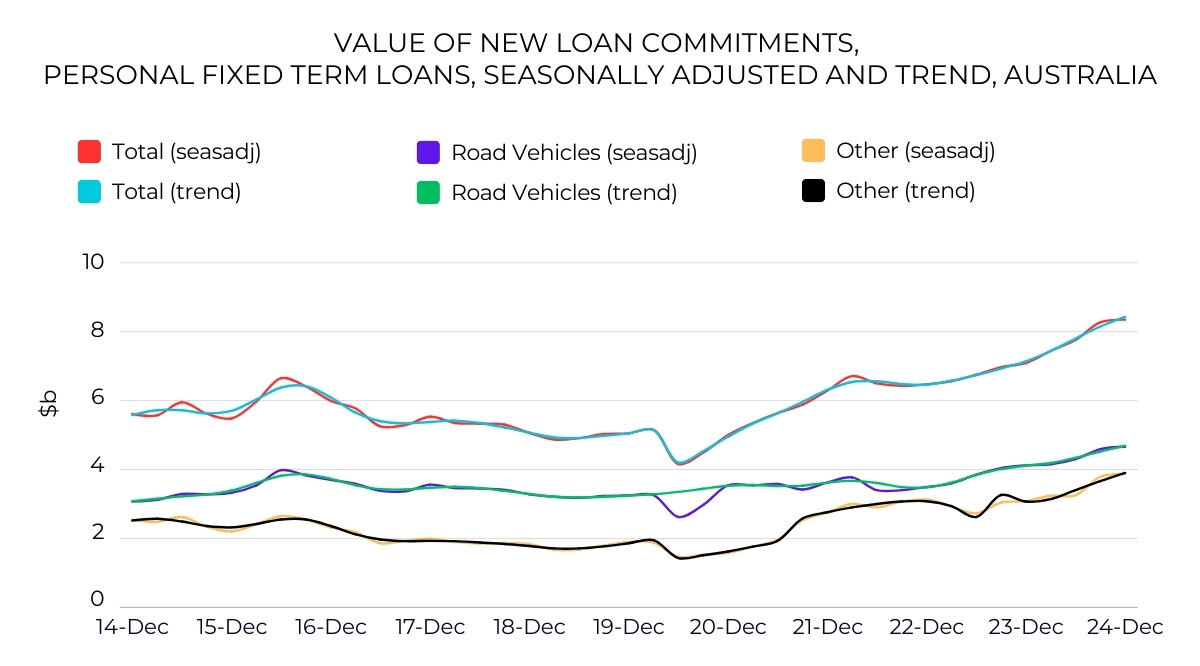

There was a sharp rise in the number of consumers taking out car loans in 2024, as motorists purchased a record number of new vehicles.

Australians bought an unprecedented 1,220,607 new vehicles last year, with Toyota, Ford, Mazda, Kia and Mitsubishi being the most popular brands, according to the Federal Chamber of Automotive Industries.

As a result, consumers took out a record $4.7 billion of car loans in the December quarter, which was 13.0% more than the year before, according to the Australian Bureau of Statistics.

Interestingly, there was an even larger rise in personal loans taken out to purchase holidays, household goods and other items – that rose by 25.9% to a record $3.9 billion.

If you’re looking to secure funds for a car or a consumer purchase, please get in touch, as a car loan or personal loan may be a better option than a credit card.