Borrowing in Today’s Market: RBA’s Cash Rate ImpactWatch the video below or read the blog.

The Perth Boom: Unravelling the Remarkable Surge

With all the recent rate rises and increases in the property market, I thought it would be interesting to work out the borrowing capacity of an average couple earning an average wage and comparing it with an average home, something a young couple would purchase for a growing family.

Property Search on the Gold Coast

So I spent a bit of time on realestate.com today, wanting to find out what an average family home, in an average suburb on the Gold Coast, would go for—something that wasn’t too flashy but you could move into and start living in right away, without having to renovate. I came across a few double-story 4-bedroom homes in Southport, with asking prices ranging from 1.4 to 1.6 million. For today’s scenario, let’s assume our young couple found one with a neat asking price of 1.5 million.

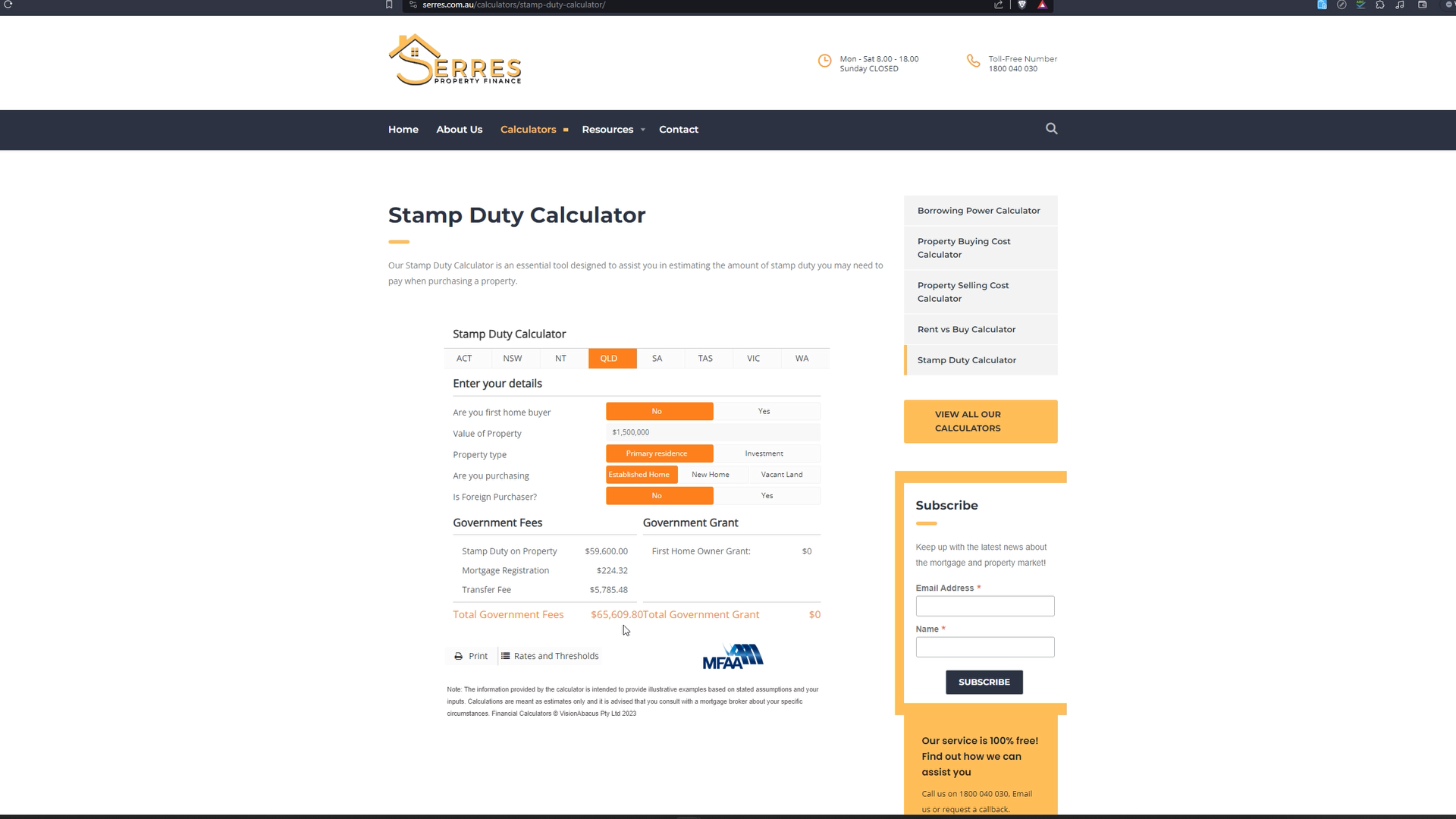

Calculating Transaction Costs

Using my website’s calculator, we find that there is about $65.5k in stamp duty and government charges. Let’s also account for $2,000 in conveyancing costs and $500 for building and pest inspections. Added together, our couple is going to need $68k to transact this property.

We aren’t going to include LMI as, for this example, we’re assuming they have sold their previous home and are looking to move into a bigger house to grow their family. They’re going to use what’s left over from the sale of their current home to cover property purchase expenses of $68k and make a down payment of $300,000, resulting in an 80% LVR loan.

Evaluating Borrowing Capacity

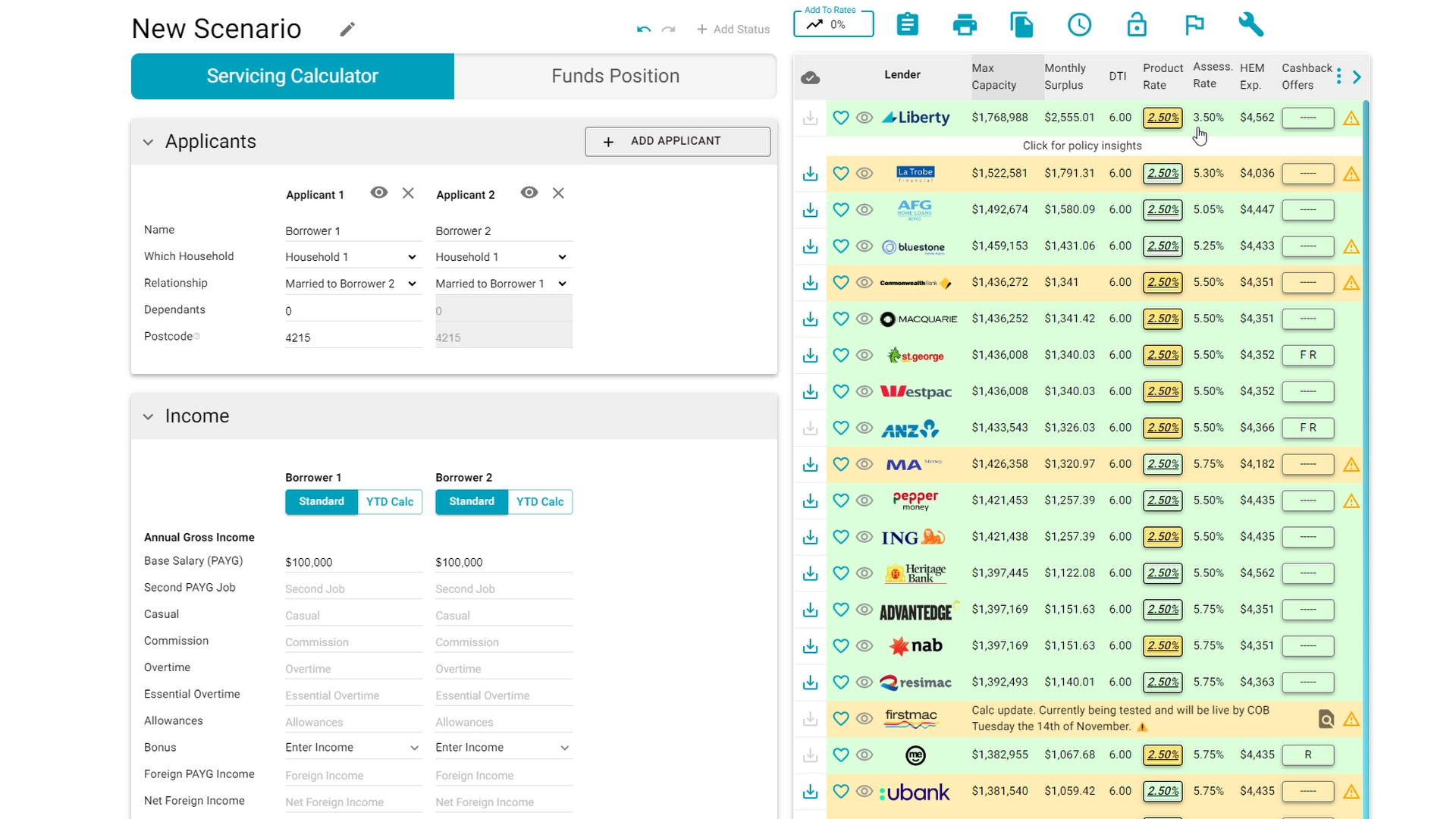

Alright, so in total, they need $368k in cash and $1.2 million in financing. To work out their borrowing capacity, let’s start by assuming this is a married couple and try plugging in the average yearly income, which sits at around $100k.

Assessing Borrowing Capacity

We can see that even with $100k in income each, their borrowing capacity sits at around $1 million, still roughly $300k off what they need. So what will it take? To achieve serviceability with most of these lenders, the amount needed is $120k each. That’s quite a substantial amount of income needed for an average home—$240k in total.

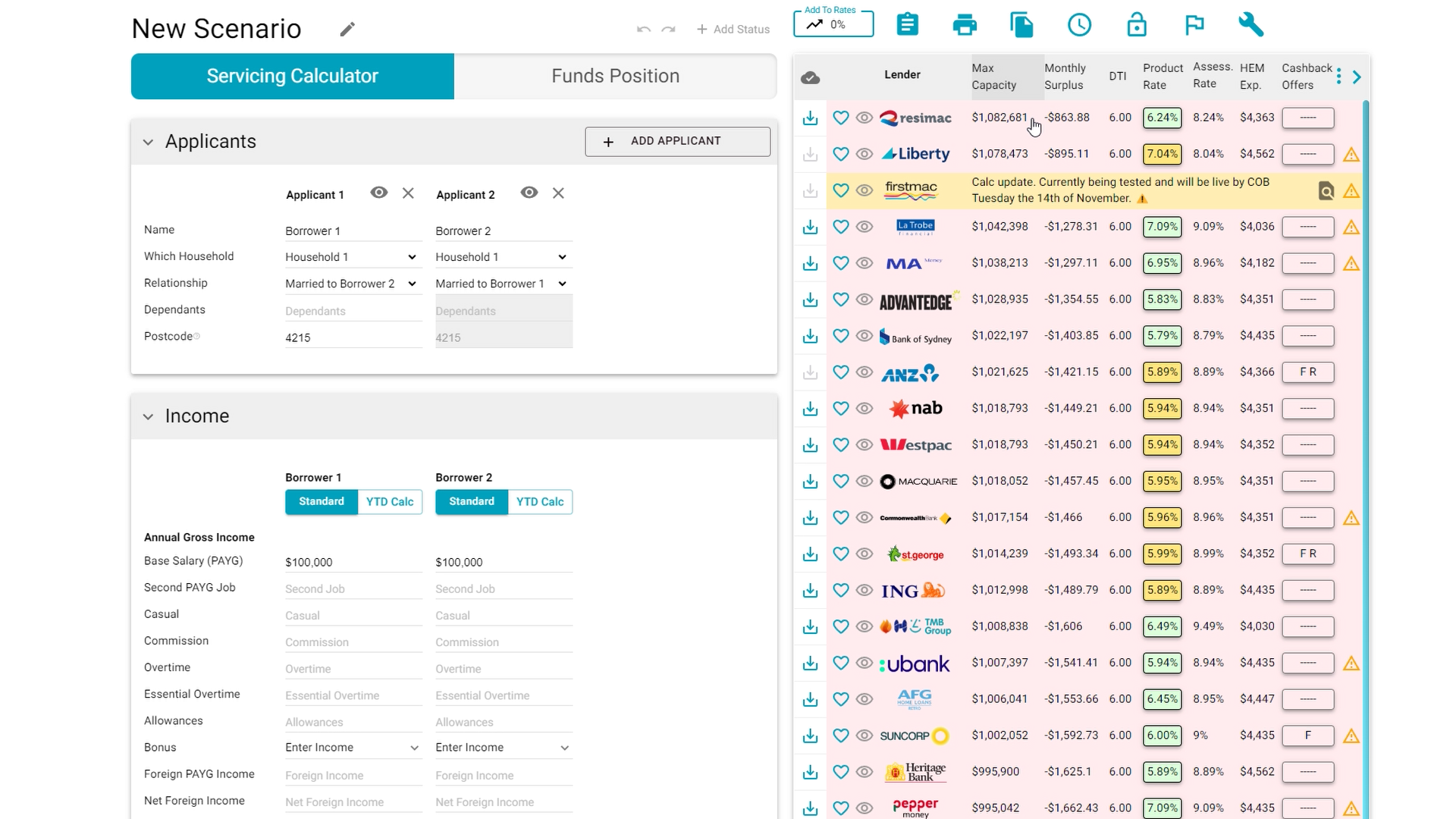

Impact of Rate Increases

The figures we just looked at demonstrate what the borrowing capacity sits at right now. However, a lot of these lenders are going to be passing a 0.25% increase to their rates. Let’s plug that number in and see how it looks. Going back to our $120k income with no kids scenario, if I adjust the rates 0.25% higher (which these banks showing up yellow have already announced), this couple’s borrowing capacity diminishes around $30k—a substantial amount, about half of the stamp duty costs for this property, gone in a single rate rise.

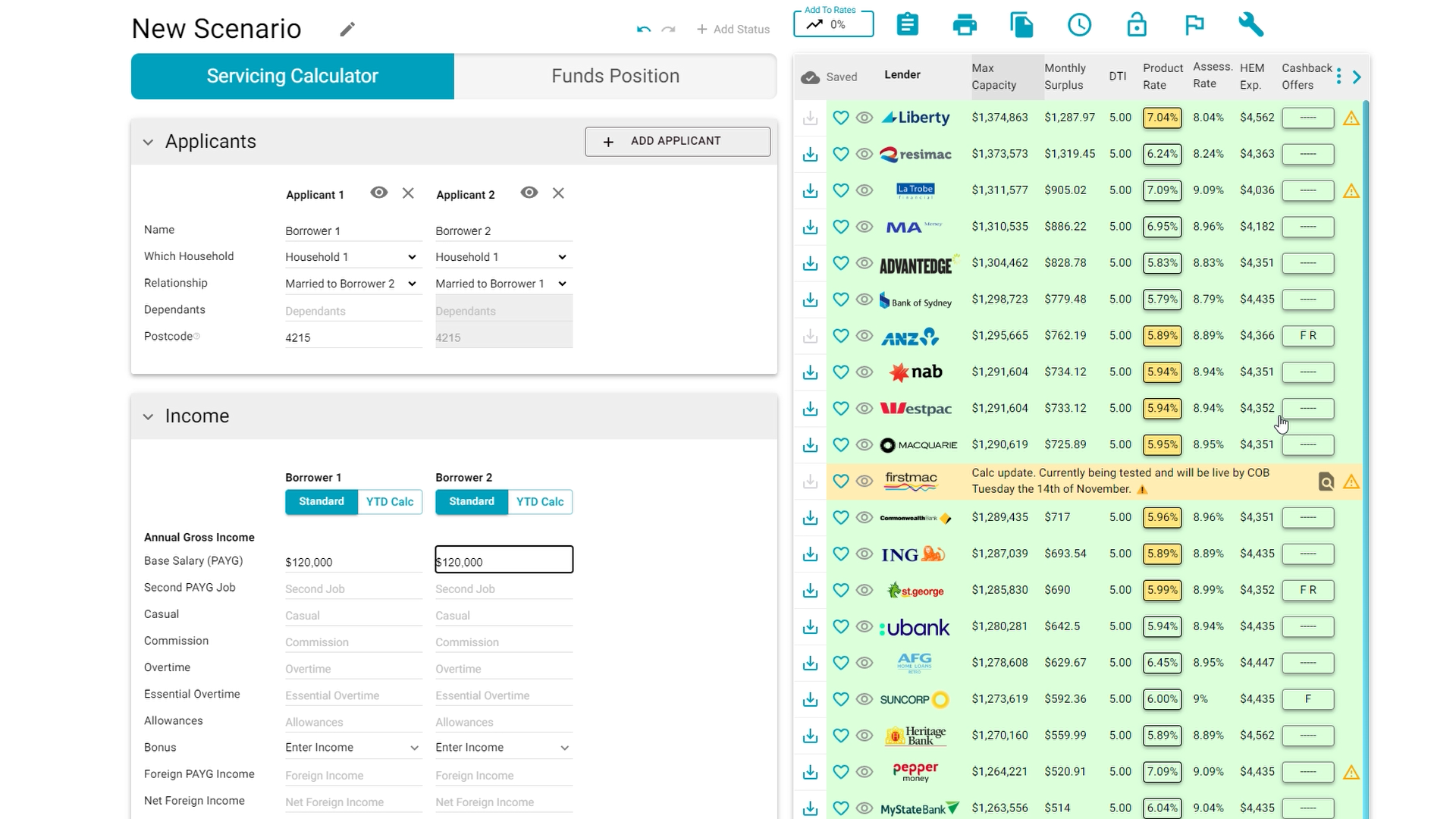

Historical Perspective: Interest Rates at 2.5%

Now, let’s rewind back to when interest rates were 2.5%. I want to show you how much the current rates have affected your borrowing capacity.

Comparing Past and Present

Going back 18 months with interest rates at 2.5%, they could service this property with most lenders at around $1.4 million. Liberty, with its loose assessment rate, was willing to lend $1.7 million to this couple back then. Even if we look at a major bank like Westpac, who won’t touch this couple today, was willing to give them $1.43 million back then. It’s crazy—they will only give them just over $1 million today. In just over a year and a half, this couple has lost over $400k in borrowing capacity.