Septembers RBA decision and its ImpactThe RBA Decision and Its Impact on the Mortgage and Property Market

The RBA's Stance on Inflation:

In our recent rate update video, we discussed the RBA’s decision to maintain the cash rate target at 4.10%. One of the pivotal factors influencing this decision is inflation. Inflation has been a primary driver behind recent cash rate adjustments. The RBA’s inflation graph indicates a peak followed by a decline. Currently, inflation stands at 4.9%, which, although high, is a notable decrease from the 7.8% recorded in December. The RBA’s projections suggest that inflation is likely to gradually return to the typical 2-3% range by late 2025. This indicates that higher interest rates are likely to persist for some time.

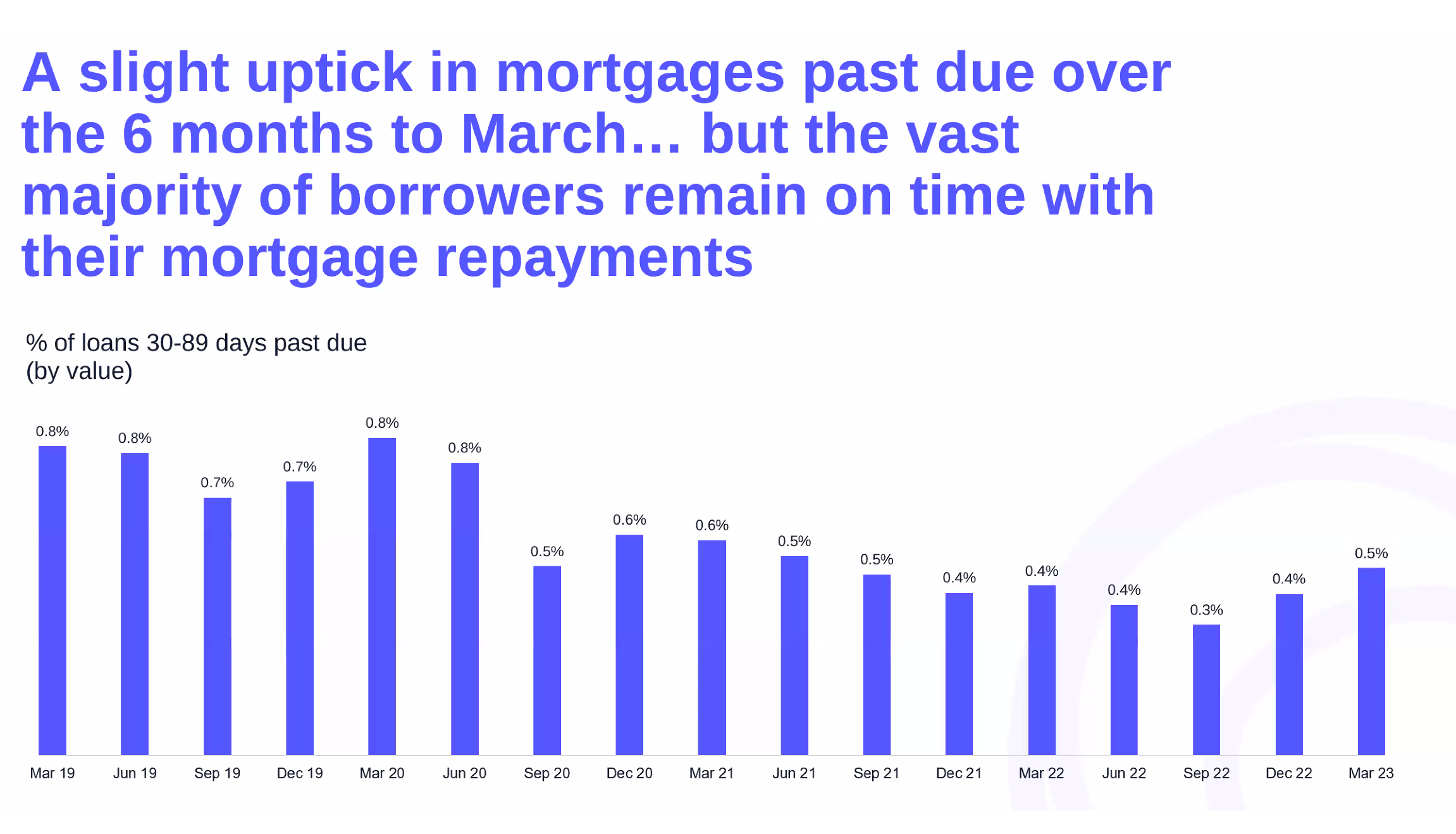

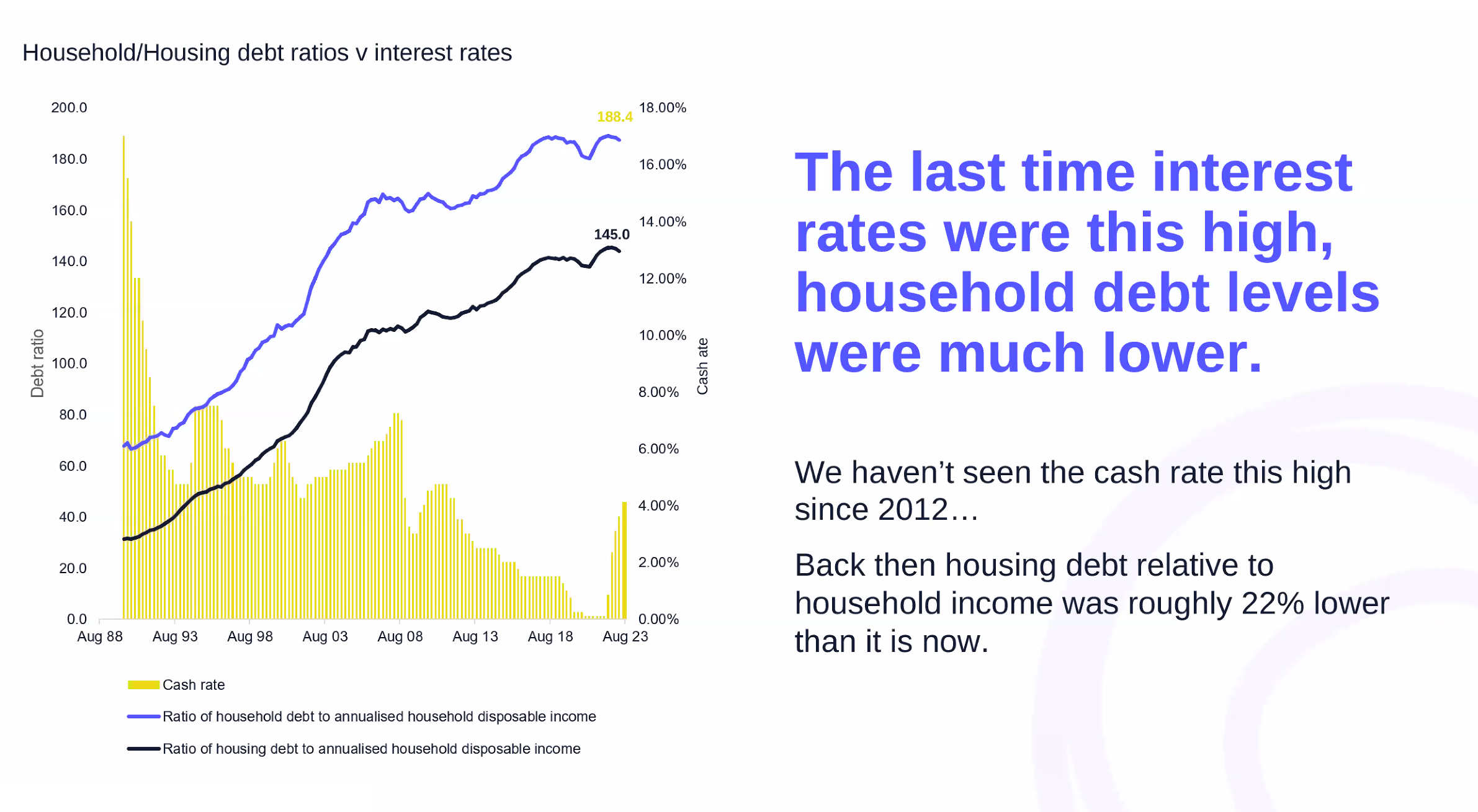

Mortgage Stress and Household Debt:

The impact of higher interest rates on mortgage stress is a concern. Recent data from March showed a slight uptick in mortgages past their due dates. It’s crucial to note that the last time interest rates were this high, household debt relative to income was 22% lower than it is today.

Despite rising repayment burdens, it’s important to highlight that this hasn’t led to significant stress in the property market. Australia’s largest home lender, CBA, even revised its initial prediction of a 6% drop in house prices for the year. They now anticipate a 7% surge in prices in 2023, citing factors such as immigration and ongoing supply shortages.

Interest Rate Trends:

A key aspect of the current landscape is interest rate trends. As a mortgage broker, I closely monitor rate changes. It’s noteworthy that many lenders have reduced their fixed rates, implying an anticipation of future interest rate drops. Variable rates, on the other hand, have seen fewer reductions, and when they do occur, they tend to be smaller.

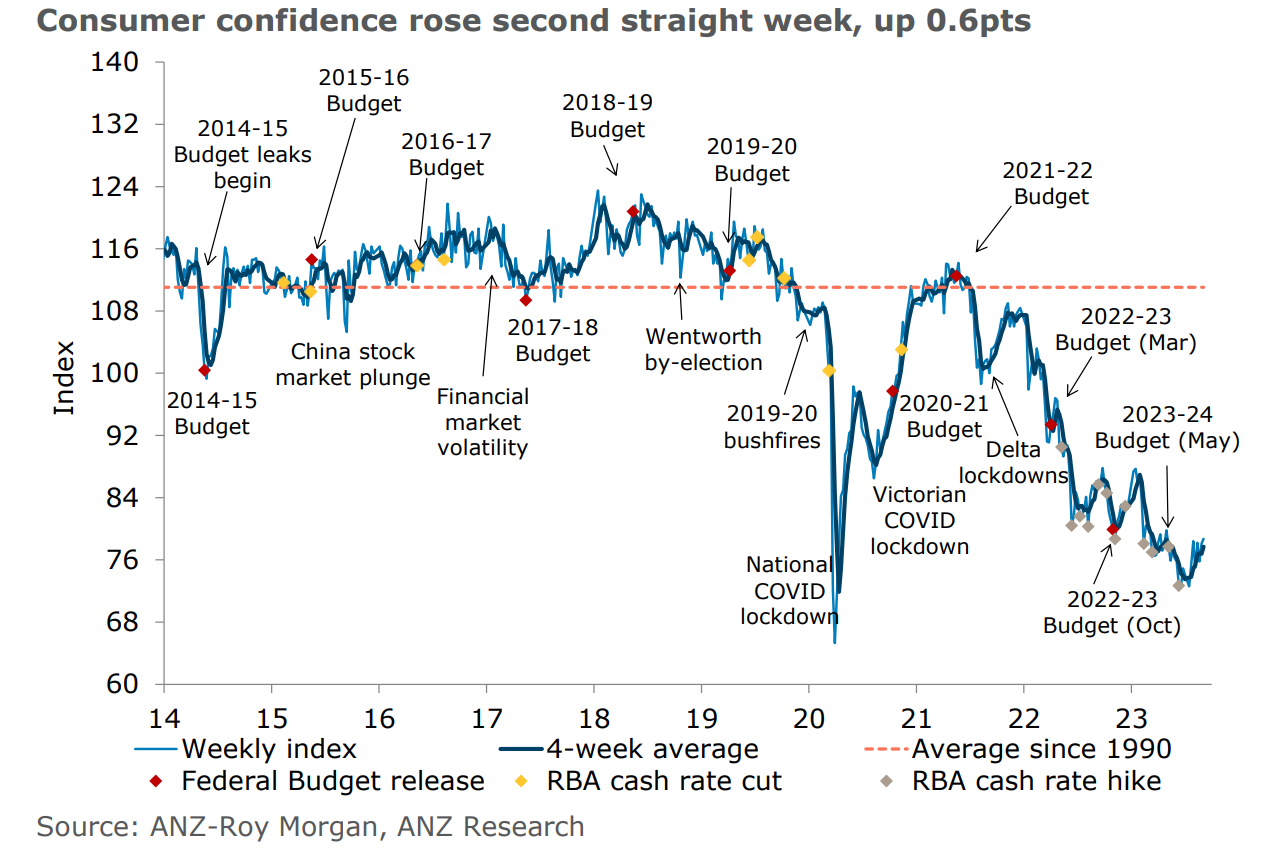

Consumer Confidence and Its Implications:

Consumer confidence metrics provide valuable insights. They influence RBA rate decisions, reflect sentiments about the economy, and correlate with consumer spending. The ANZ-Roy Morgan Consumer Confidence metric recently saw a slight increase, reaching 78.7.

However, it’s important to note that this index has spent a record 27 consecutive weeks below the 80 mark, indicating ongoing doubts about the economy. Nevertheless, recent data suggests that people are cautiously optimistic about the future.

China's Economic Uncertainty:

Another factor that has emerged as a significant uncertainty is China’s deteriorating economic outlook. The outgoing RBA Governor expressed concerns about this issue. China is currently grappling with a real estate collapse, notably with Evergrande, the world’s most heavily indebted property developer. Its debt of 408 billion has raised significant concerns. In late 2021, Evergrande defaulted on its debt, and in August of this year, it filed for bankruptcy protection.

This crisis extends beyond Evergrande; even China’s largest real estate developer, Country Garden Holdings, recently missed a debt payment of 4.2 million. The implications of these massive debts are significant, given that a substantial portion of Australia’s exports is tied to China’s real estate development industry. Hence, the RBA’s vigilance in monitoring this situation is entirely warranted.

Conclusion:

In conclusion, the recent RBA decision to maintain the cash rate target has far-reaching implications for the mortgage and property market. With inflation on the decline but still relatively high, the landscape suggests that higher interest rates will persist for some time. Despite concerns about mortgage stress, the property market appears resilient, with predictions of price surges in 2023. Interest rate trends, consumer confidence, and China’s economic uncertainty further shape the complex landscape of mortgage and property finance.