Why hasn’t the market fallen off a cliff?Understanding the Confusion in the Current Real Estate Market

Over the years, predictions around property prices have often missed the mark. Last year, many banks and experts predicted a price drop of between 20-30% due to rising interest rates, a classic indicator of a cooling property market. Contrary to these forecasts, house prices in major Australian cities dipped by only 6.4%. So, what gives?

Varying Factors Influencing the Market

Historically, rising interest rates have been known to cause significant drops in property values. However, despite global inflation, increasing interest rates, and some regions experiencing a recession, real estate prices worldwide are once again on the rise. This highlights the need to consider multiple factors when analysing the market.

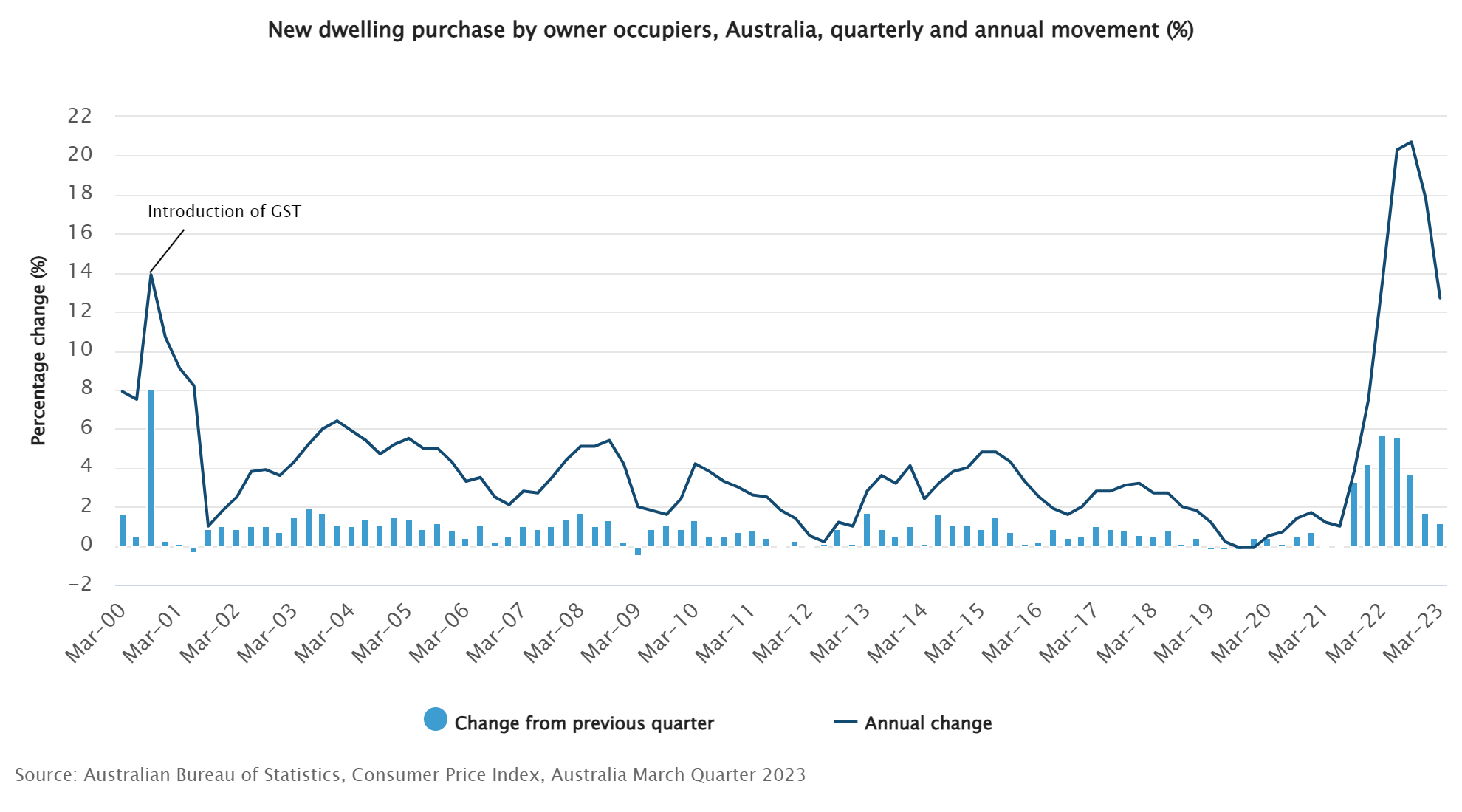

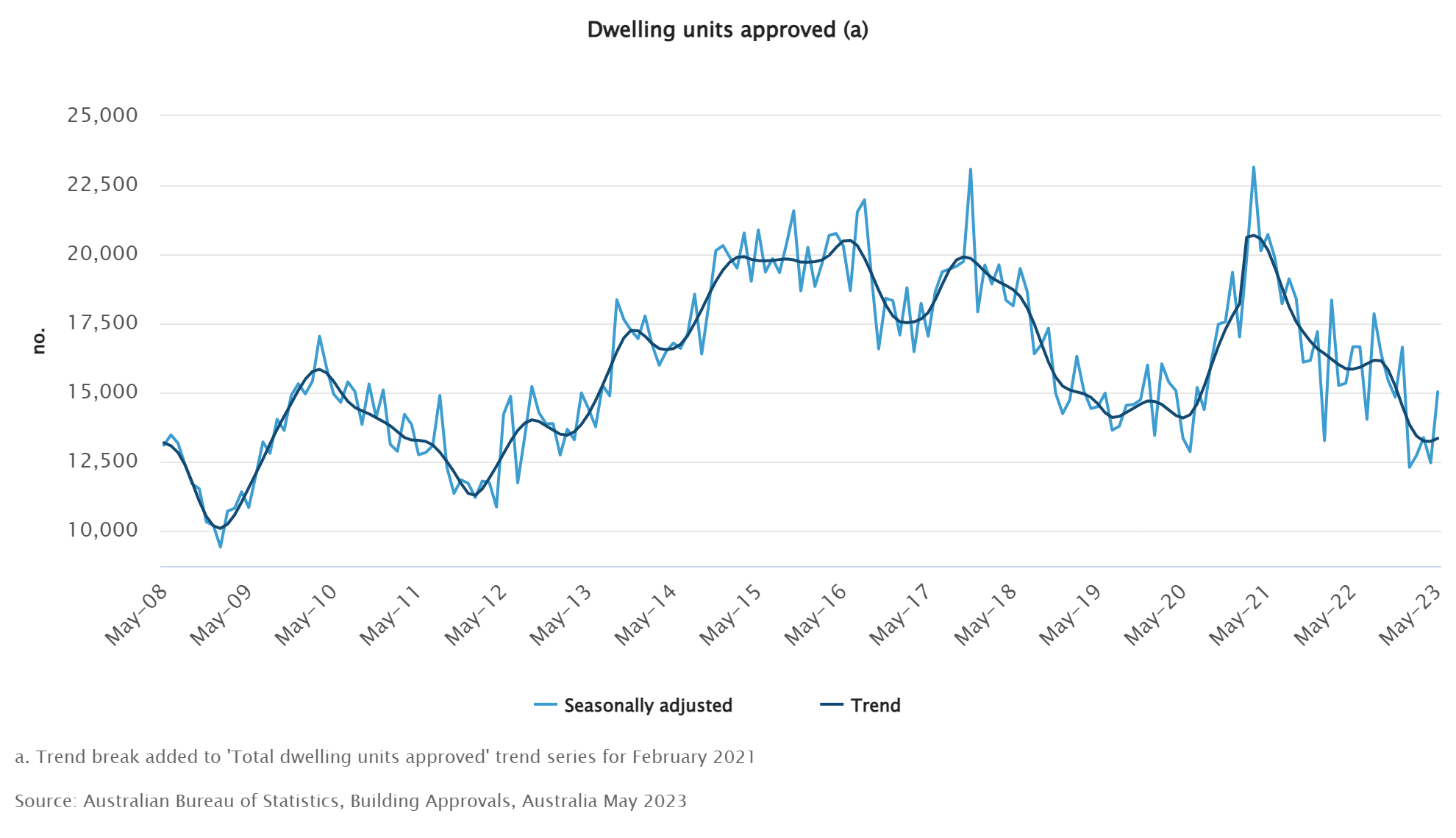

Currently, there is an overemphasis on interest rates as the primary driver of house price movements. However, it is crucial to acknowledge other critical factors, such as the severe housing shortage and record-high housing growth. Neglecting these factors leads to an incomplete understanding of the market dynamics. An example of this is shown in the graphs below.

The Discrepancy in House Prices

Debunking Assumptions

- Factor Monotony: Property prices aren’t influenced solely by a single factor like population growth. Multiple variables like housing shortages and construction costs can counterbalance the effect of interest rates.

- Market Uniformity: It’s a mistake to think all housing markets operate the same. Price fluctuations can differ between cities and even neighbouring suburbs, influenced by unique factors like commodities or local business activity.

- Lifestyle Changes: Economic statistics alone don’t shape the property market; shifts in lifestyle and work habits, particularly accelerated by the pandemic, also play a significant role.

- Financial Market Analogy: The property market does not behave like the stock market. Given that property transactions take time to complete, the real estate market experiences less volatility.

Stability and Long-Term Trends

Contrary to popular belief, house prices are generally less volatile compared to financial markets. The cost and speed of transactions, as well as the settlement process, contribute to the stability of the housing market. Unlike shares that can be traded within minutes, housing transactions are relatively slower, making them less susceptible to rapid changes in market conditions.

It is essential to distinguish between housing markets and financial markets. While financial factors do influence the housing market, demographic changes also play a significant role. Changes in the way people live and work heavily impact property markets beyond residential properties. For example, shopping centres can thrive even in a poor retail environment if there is strong population growth, and industrial properties are doing well due to the shift in shopping behaviour.

What's happening now?

Interestingly, despite the onset of inflation and interest rate hikes, global real estate prices are climbing. In Australia, the RBA’s decision not to increase the cash rate for the last two months is seen as a sign that we’ve likely hit the peak of interest rate rises. This leads to an interesting conversation around Australia potentially beating inflation without diving into a recession.

The “Mortgage Cliff” That Wasn’t

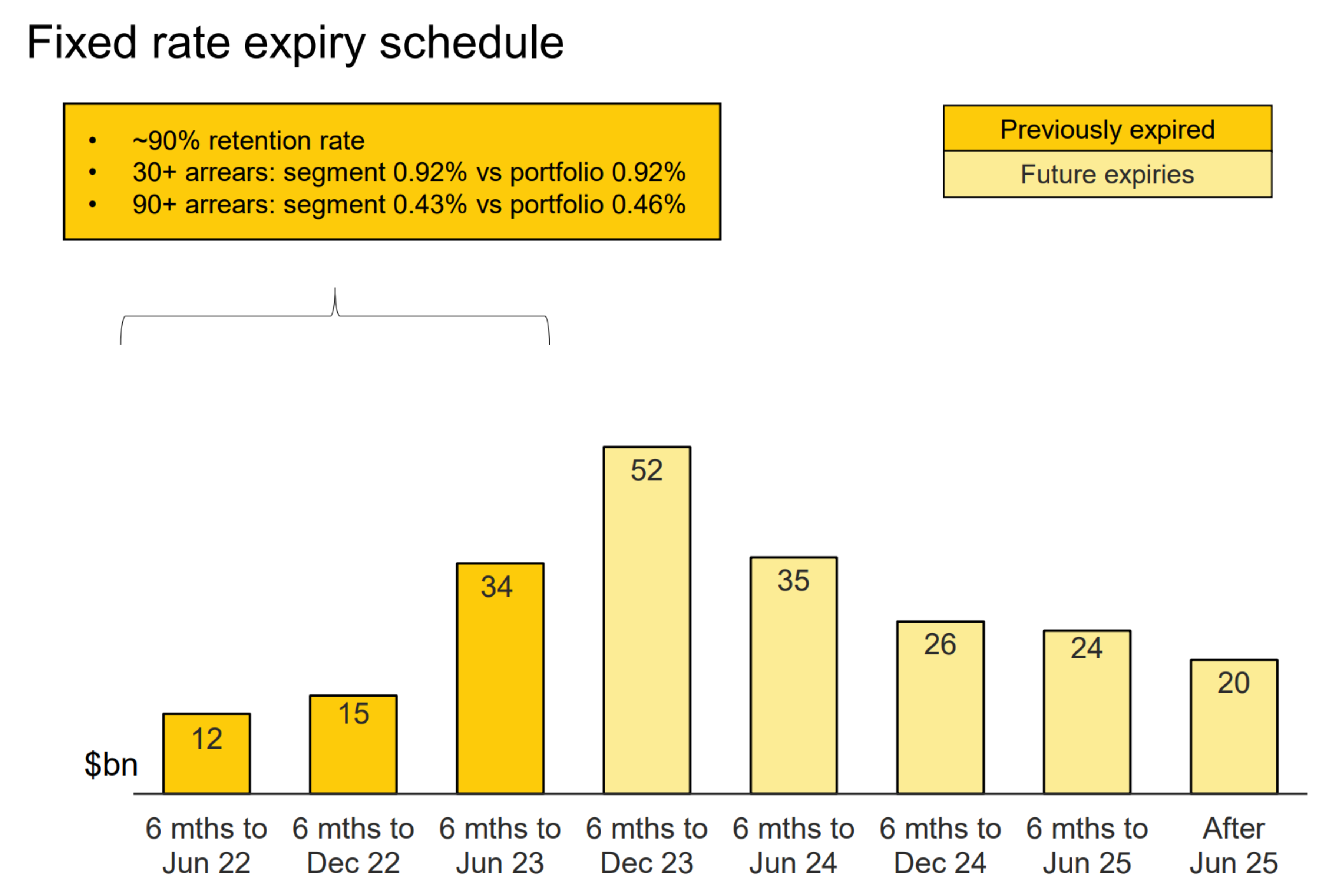

Commonwealth Bank of Australia (CBA) recently indicated that a large number of low fixed-interest rate periods are ending soon. Contrary to the doom-and-gloom predictions of a “mortgage cliff,” auction clearance rates nationwide suggest the market remains robust and seller-friendly.

Conclusion

In conclusion, the confusion surrounding the Australian real estate market stems from the complexity of its dynamics. Multiple factors contribute to house price movements, and their influence can vary across different regions. Understanding the interplay between these factors and long-term trends is essential for accurate forecasting.

To make informed decisions about entering the property market, it’s crucial to understand the multifaceted nature of the factors at play. Remember, no single indicator should dictate your investment strategy. If you’re keen on a free home loan health check or want a comprehensive property report, feel free to contact us. We’re here to help you navigate your property investment journey.